Nolus: The 2.0 DeFi of the Cosmos Ecosystem

🌟 Introduction

Launched in 2023, Nolus is an innovative DeFi project that aims to transform financing access via its decentralized DeFi Leasing concept.

- It provides simplified access to leveraged financing while reducing the risks tied to traditional DeFi loans.

- Its development is based on the Cosmos SDK and inter-blockchain communication via IBC, ensuring secure and efficient exchanges between blockchains.

🎯 Project Objectives

- Facilitate access to financing by lowering entry barriers.

- Improve the user experience with simplified loans and leasing options.

- Combine the best of Web2 and Web3 experiences for more intuitive use.

🤔 Leasing vs Lending in DeFi

Leasing and Lending/Borrowing are two key concepts in DeFi, but they function differently. Here’s a simple explanation:

1. Leasing (Lease-to-Own Model)

The DeFi Lease, as introduced by Nolus, acts as a partial credit solution, enabling users to acquire assets with leveraged exposure.

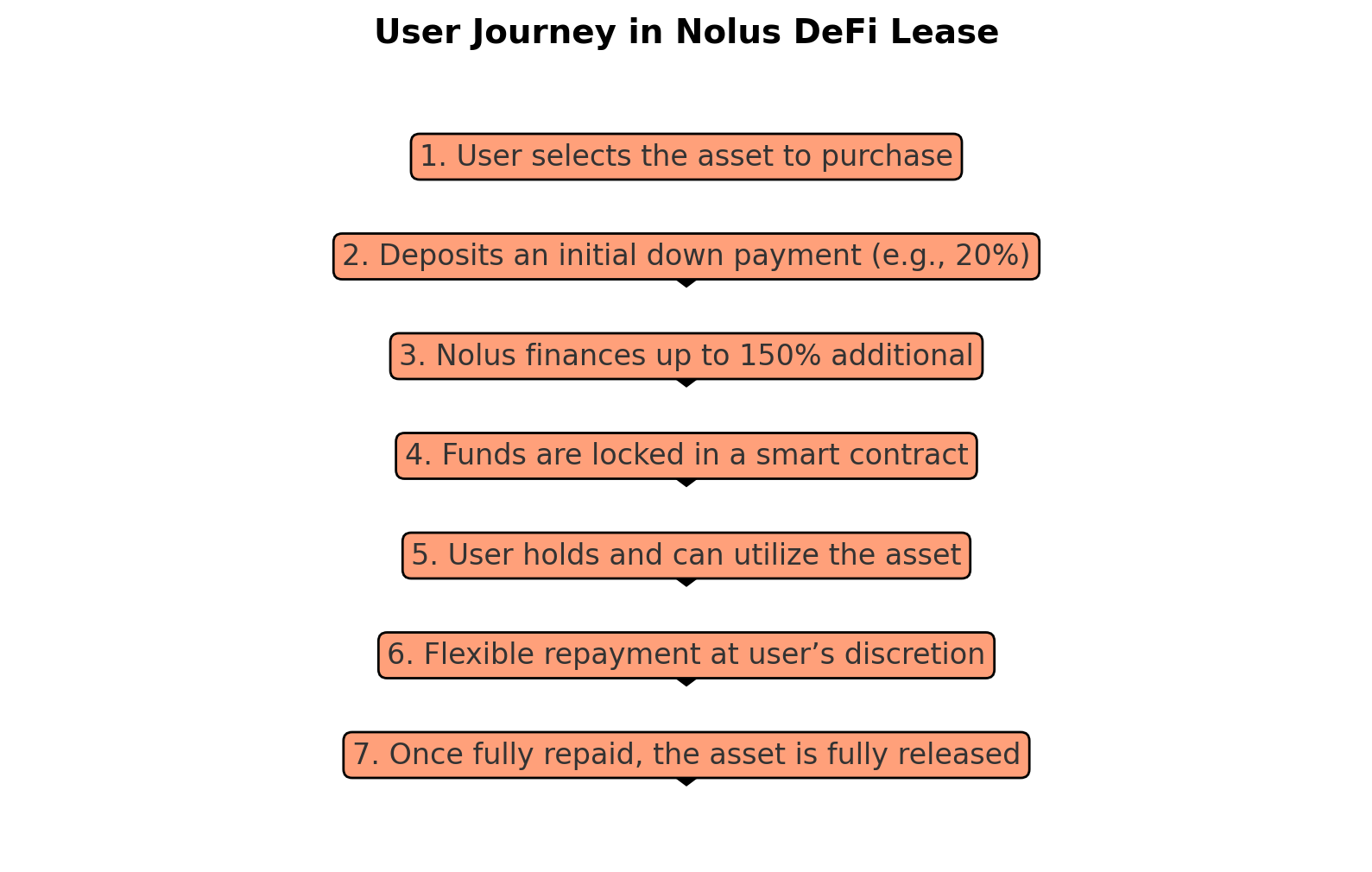

How does it work?

- The user provides an initial down payment (e.g., 20% of the total value).

- Nolus finances up to 150% of the initial investment.

- The user retains ownership of the assets while gaining access to additional liquidity.

- They can repay at their own pace, with no penalties or fixed installments.

- Once the debt is fully repaid, they own the asset outright.

Advantages:

✅ Access to more capital without selling assets.

✅ Lower liquidation risk than traditional loans

✅ Flexible repayment terms.

2. Lending & Borrowing (Traditional Loan Model)

In a standard DeFi lending/borrowing model, there are two parties:

- The lender deposits assets (e.g., stablecoins) to earn yield.

- The borrower provides collateral (often 150% or more of the borrowed amount) and receives a loan.

How does it work?

- The borrower deposits collateral (e.g., ETH) and gets a loan (e.g., USDC).

- They can use the funds, but if the collateral value drops too much, liquidation may occur.

- The lender earns interest on their deposit.

Pros & Cons:

✅ Provides liquidity without selling assets.

❌ High liquidation risk in volatile markets.

❌ Often requires over-collateralization (100-200%).

3. Key Differences

| Criteria | Leasing (e.g., Nolus) | Traditional Lending/Borrowing |

|---|---|---|

| Collateral | Lower initial deposit (e.g., 20%) | Requires over-collateralization (e.g., 150%) |

| Liquidation Risk | Lower risk (40% lower liquidation rate than the market) | High risk if collateral value drops |

| Repayment | Flexible, no fixed installments | Often variable interest rates |

| Asset Ownership | Yes, the user retains ownership even during leasing | No, the asset is used as collateral |

4. More Buying Power, but Controlled Asset Access

The DeFi Lease by Nolus is an alternative to traditional lending, allowing users to increase exposure without locking excessive capital. Nolus finances up to 150% of the investment, reducing collateral requirements and liquidation risks.

However, the financed asset remains locked in a smart contract until the debt is fully repaid

In practice:

- The user can utilize the asset (staking, farming, internal trading).

- But they cannot withdraw it to an external wallet before full repayment.

- Once the debt is cleared, they gain full ownership of the asset.

This model secures the protocol while offering better access to financing, with optimized leverage and no over-collateralization.

Conclusion

The DeFi Lease is an innovative alternative that enables controlled leverage without the constraints of traditional lending. Nolus makes this approach more accessible and less risky, ensuring continuous asset ownership and a fixed repayment rate.

👥 Team and Vision

The Nolus team is made up of 25 members, including 18 developers.

Leadership and Key Members

- Ivan Kostov – Co-founder & Product Lead

- Expert in blockchain product development.

- Official project spokesperson at conferences and events.

- Zaki Manian – Strategic Advisor

- A key figure in the Cosmos ecosystem (Iqlusion, Sommelier Finance).

- Jack Zampolin – Technical Advisor

- Former technical architect of Tendermint.

- Specialist in Cosmos interconnections.

💰 Investors and Strategic Partners

Investor Partners:

- DoraHacks: Major Web3 project accelerator.

- Everstake: Renowned blockchain infrastructure provider & validator.

- Cogitent Ventures: Crypto-focused investor.

- Token Metrics Ventures: Key investor in multiple DeFi projects.

- Autonomy Capital: Active venture capital fund in the Cosmos ecosystem.

Key Partnerships

- Leap Wallet: Smooth mobile integration.

- Osmosis: Liquidity optimization using Alloyed Assets.

- Stride, Juno, Kujira, and ATOM: Cross-chain connections via IBC.

🏗️ Technology and Innovations

⚡ DeFi Lease: A Unique Financing Model

- Offers financing of up to 150% of the initial investment.

- Reduces liquidation risks while maintaining full ownership of assets.

🔄 Integration of Cosmos SDK 47 and CometBFT

- Enhanced consensus mechanisms for faster transactions.

- Better compatibility with decentralized price oracles.

💳 Fee Abstraction

- Paying transaction fees with various tokens (e.g., axlUSDC).

🔗 Alloyed Assets: A Solution Against Liquidity Fragmentation

- Decreases risks tied to price fluctuations by integrating Osmosis’s Alloyed Assets.

💎 Tokenomics and Governance

The native $NLS token plays a key role in the Nolus ecosystem.

📜 $NLS Token Overview

- Securing the network via Proof-of-Stake.

- Community governance participation through votes.

- Transaction fee payments on the Nolus blockchain.

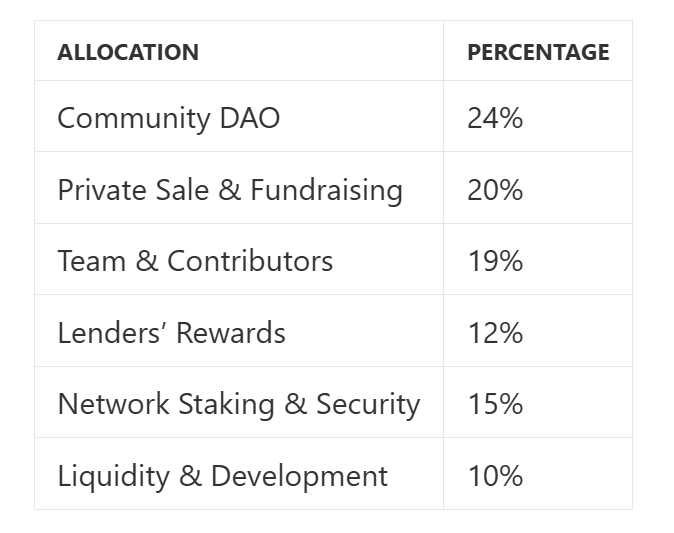

📊 Token Distribution

🎁 Incentive Program

- Reduced interest rates based on $NLS staking.

- Boosted yields for lenders proportional to their $NLS staking.

- Buyback mechanism using lease profits to purchase $NLS.

📊 Current Status and Prospects for Nolus ($NLS)

With a market cap of $3.33M and a current price of $0.0069, Nolus has been experiencing a notable correction since its launch. Its TVL of $693K shows that the protocol remains in a growth phase but has yet to reach broad adoption.

📊 Current $NLS Market Data

- Current Price: $0.006949

- Market Cap: $3.33M

- Fully Diluted Valuation (FDV): $6.09M

- 24h Trading Volume: $232.1K

- Total Value Locked (TVL): $693.5K

- Circulating Supply: 480M NLS

- Total Supply: 878M NLS

- Max Supply: 1B NLS

Although the price has fallen sharply from its historical high (~$0.12), multiple factors can influence its future performance:

🔎 Analysis and Outlook

📉 Reasons Behind the Price Drop

- Selling pressure following the initial launch and token distribution.

- Insufficient liquidity and adoption to sustain $NLS demand.

- Overall crypto market sentiment, which may affect token performance.

📈 Positive Factors

- An active community (over 25K wallets added $NLS on CoinGecko).

- Continued trading volume, indicating ongoing market activity.

- Real-world token utility in the Nolus protocol, potentially stabilizing long-term demand.

- Strategic partnerships within Cosmos, Osmosis, and other interoperable blockchains.

⚠️ Points to Watch

- TVL Evolution: A rising TVL would reflect increased DeFi Lease adoption and better user retention.

- Protocol Development: Major updates (like improved Cosmos interoperability or new partnerships) could renew interest in $NLS.

- Overall Crypto Market Sentiment: A general market recovery could help bolster the token’s valuation.

Currently, Nolus must strengthen its liquidity and encourage more users to leverage the protocol for a chance at a stable and sustainable token price. The real adoption of its DeFi Lease solution will be pivotal for its long-term success.

Conclusion: Is Nolus the Future Leader of DeFi 2.0?

Nolus stands out through its decentralized leasing model, its optimized leverage feature, and its interoperability with Cosmos—all assets that could position it as a major player in the new generation of DeFi. By making financing more accessible and secure, it paves the way for broader adoption of the DeFi Lease in the Cosmos ecosystem and beyond.

Still in its development phase, the project continues to improve its scalability, liquidity, and user experience, all crucial elements to establish a strong position in the market. Its success in 2025 and beyond will depend on its ability to attract more users and deepen its impact on the ecosystem.

With robust tokenomics, a strategic buyback mechanism, and a team supported by recognized Cosmos experts, Nolus has everything required to become a benchmark in DeFi Lease. This is certainly a project to keep an eye on.

💡 Its success after 2025 will primarily depend on its adoption and the growth of its ecosystem.

🔗 Official Resources

➡️ Site Web

➡️ Discord

➡️ Telegram

➡️ GitHub

➡️ Whitepaper

Transparency & Commitment

At Inter Blockchain Services (IBS), we are proud to actively contribute to the security and development of the Axelar Network as a validator and infrastructure relay.

This article is educational in nature: it is neither promotional nor financial advice. Our goal is to provide an independent and clear analysis of Web3 technologies and the innovations shaping blockchain interoperability.

Support Inter Blockchain Services

📌 Stake your NLS with IBS: You can support our work by delegating your NLS to Inter Blockchain Services. By doing so, you help secure the network alongside us while optimizing your staking rewards.

Join Us & Stay Informed

🚀 Stay at the forefront of Web3 by following us on X to keep up with the latest advancements in the Cosmos ecosystem. 📢 Engage with us on Discord.

Block by block, we are building a new decentralized world, where transparency and governance are at the heart of our actions. Join Inter Blockchain Services and be an active part of the Web3 revolution!